Can one individual make a distinction to the worth of a enterprise? In fact, and with small companies, particularly these constructed round private companies (a health care provider or plumber’s apply), it’s a part of the valuation course of, the place the important thing individual is valued or no less than priced and integrated into valuation. Whereas that impact tends to fade as companies get bigger, the tumult at Open AI, the place the board dismissed Sam Altman as CEO, after which confronted with an enterprise-wide meltdown, as capital suppliers and workers threatened to give up, illustrates that even at bigger entities, an individual or just a few folks could make a price distinction. In reality, at Tesla, an organization that I’ve valued at common intervals over the past decade, the query of what Elon Musk provides or detracts from worth has grow to be extra vital over time, somewhat than fading. Lastly, Charlie Munger’s passing on the age of ninety-nine delivered to an in depth some of the storied key individual groups of all time at Berkshire Hathaway, and generations of traders who had connected a premium to the corporate due to that staff’s presence mourned.

Key Particular person: Who, what and why?

Whereas it’s typically assumed that key folks, no less than from a price perspective, are on the prime of the group, often founders and prime administration, we are going to start this part by increasing the important thing individual definition to incorporate anybody in a corporation, and typically even exterior it. We’ll then observe up with a framework for fascinated with how key folks can have an effect on the worth of a enterprise, with sensible recommendations on valuing and pricing key folks. We’ll finish with a dialogue of how enterprises attempt, with combined results, to construct protections in opposition to the lack of key personnel.

Who’s a key individual?

Within the Open AI, Tesla and Berkshire Hathaway instances, it’s individuals on the prime of the group which were recognized as key worth drivers, however the important thing folks in a corporation could be at each stage, with differing worth results.

- It begins in fact with founders who create organizations and lead them via their early years, partly as a result of they symbolize their firms to the remainder of the world, however extra as a result of they mildew these firms, no less than of their adolescence. It’s value noting that whereas some attain legendary standing, sharing their names with the group (like Ford and HP), others are unceremoniously pushed apart, as a result of they have been considered, rightly or wrongly, as unfit to guide their very own creations.

- Staying on the prime, CEOs for firms typically grow to be entwined with their firms, particularly as their tenure lengthens. From Alfred Sloan at Common Motors to Jack Welch at Common Electrical to Steve Jobs at Apple, there’s a historical past of CEOs being tagged as superstars (and indispensable to the organizations that they head), in profitable firms. By the identical token, as with founders, the failures of companies typically rub off on the folks heading them, pretty or unfairly.

- As you progress down the group, there could be key gamers in nearly each facet of enterprise, with scientists at pharmaceutical firms who give you pathbreaking discoveries that grow to be the premise for blockbuster medication or design specialists like Jon Ive at Apple, whose styling for Apple’s units was considered as a crucial element of the corporate’s success. The abilities they convey could be distinctive, or no less than very troublesome to interchange, making them indispensable to the group’s success.

- In companies pushed by promoting, a master-salesperson or dealmaker can grow to be a central driver of its worth, bringing in a clientele that’s extra connected to the gross sales personnel than they’re to the group offering the services or products. In companies like banking, consulting or the legislation, rainmakers can symbolize a good portion of worth, and their departure could be not simply damaging however catastrophic.

- In people-oriented companies, particularly in service, a supervisor or worker that cultivates sturdy relationships with clients, suppliers and different workers, generally is a key individual, with the lack of that individual resulting in not simply misplaced gross sales, as purchasers flee, however create ripple results throughout the group.

- In some companies, the key individual could not work for the group however contribute a major quantity to its worth as a spokesperson or product brander. In sports activities and leisure, as an illustration, enterprise can achieve worth from having a celeb representing them in a paid or unpaid capability. In my valuation of Birkenstock for his or her IPO, only a few weeks in the past, I famous the worth added to the corporate by Kate Moss or Steve Jobs sporting their sandals. Over the a long time, a major a part of Nike’s worth has been gained and typically misplaced from the celebrities who’ve connected their names to its footwear.

Briefly, the important thing individual or folks in a corporation can vary the spectrum, with the one factor in widespread being a “vital impact” on worth or worth.

Key Particular person(s): Worth results

Given my obsession with worth, it ought to come as no shock that my dialogue of key folks begins by wanting on the many ways in which they’ll have an effect on worth. As I establish the a number of key individual worth drives, word that not all key folks have an effect on all worth drivers, and the worth results can even fluctuate not solely extensively throughout key folks, however for a similar key individual, throughout time. On the threat of being labeled as a one-trick pony, I’ll use my intrinsic worth framework, and by extension, the It Proposition, the place if it doesn’t have an effect on money circulate or threat, it can not have an effect on worth, to put out the completely different results a key individual can have on worth:

For personnel on the prime, and I embrace founders and CEOs, the impact on worth comes from setting the enterprise narrative, i.e., the story that animates the numbers (income development, revenue margins, capital depth and threat) that drives worth., and that impact, as I’ve famous in my earlier discussions of narrative and numbers, could be all encompassing. The consequences of individuals decrease down within the group are typically extra centered on one or two inputs, somewhat than throughout the board, however that doesn’t preclude the impact from being substantial. A salesman who accounts for half the gross sales of a enterprise and most of its new clients will affect worth, via revenues and income development, whereas an operations supervisor who’s a provide chain wizard can have a big affect on revenue margins. As somebody who teaches company finance, I’ve at all times tried to go on the message, particularly to those that are headed to finance jobs at firms or funding banks, that of the entire gamers in a corporation, finance individuals are among the many most replaceable, and thus least more likely to be key folks. It’s maybe the explanation that you’re much less more likely to see an organization’s worth implode even when a well-regarded CFO leaves, although there are exceptions, particularly with distressed or declining firms, the place monetary legerdemain could make the distinction between survival and failure.

With this framework, valuing a key individual or individuals turns into a easy train, albeit one which will require complicated assumption. To estimate key individual worth, there are three normal approaches:

1. Key individual valuation: You worth the corporate twice, as soon as with the important thing individuals included, with all that they convey to it’s money flows and worth, after which once more, with out these key individuals, reflecting the modifications that can happen to worth inputs:

Worth of key individual(s) = Worth of enterprise with key individual – Worth of enterprise with out key individual

A key individual whose impact on a enterprise is identifiable and remoted to one of many dimensions of worth will likely be simpler to worth than one whose results are disparate and troublesome to isolate. Thus, valuing a key salesperson is less complicated than valuing a key CEO, because the former’s results are solely on gross sales and could be traced to that individual’s efforts, whereas the impact of a CEO could be on each dimension of worth and troublesome to separate from the efforts of others within the group.

2. Alternative Value: In some instances, the worth of a key individual could be computed by estimating the price of changing that individual. Thus, key folks with particular and replicable abilities, reminiscent of expert scientists or engineers, could also be simpler to worth than key folks, with fuzzier ability units, reminiscent of sturdy connections and other people abilities. Nevertheless, discovering replacements for folks with distinctive or blended abilities could be harder, since they might not exist.

3. Insurance coverage cost: Lastly, there are some key folks in a corporation who could be insured, the place insurance coverage firms, in return for premium funds, pays out an quantity to compensate for the losses of those key folks. For firms that purchase insurance coverage, the important thing individual worth then grow to be monetized as a price, lowering the worth of those firms when the important thing individual is current, whereas growing its worth, when it loses that individual.

The important thing individual valuation method, whereas normal, cannot solely yield completely different values for key folks, but in addition generate a price impact that’s damaging for a key individual whose affect has grow to be malignant. The framework can even assist clarify how the worth of a key individual can evolve over time, from a major constructive at one stage of a corporation to impartial later and even a big damaging, explaining why some key folks get pushed out of organizations, together with those who they might have based.

Key Particular person(s): Pricing results

It’s true that markets are pricing mechanisms, not devices for reflecting worth, no less than within the quick time period, and it ought to come as no shock then that the results of a key individual are captured in pricing premiums or reductions, someday arbitrary, and typically primarily based upon information. On this part, I’ll begin with the practices utilized by appraisers to attempt to alter the pricing of companies for the presence or potential lack of a key individual after which transfer on to how markets react to the lack of key personnel at publicly traded firms.

In appraisal apply, the impact of the potential lack of an proprietor, founder or different key individual in a enterprise that you’re buying is often captured with a key individual low cost, the place you worth the enterprise first, primarily based upon its current financials, after which scale back that pricing by 15%, 20% or extra to replicate the absence of the important thing individual. Shannon Pratt, in his extensively used work on valuing personal firms, recommended a key individual low cost of between 10%-25%, although he left the quantity nearly totally to appraiser discretion. As well as, the character of personal firm appraisal, the place valuations are finished for tax or authorized functions, has additionally meant that the appropriate ranges of low cost for key folks have been decided extra by courts, of their rulings on these valuations, than by first ideas.

In public firms, the market response to the lack of key personnel could be a sign of how a lot traders priced the presence of these personnel. Empirically, the analysis on this space is deepest on CEO departures, with the market response to these departures damaged down by trigger into Acts of God (loss of life), firing or retirement.

- CEO Deaths: Within the HBO hit collection, Succession, the loss of life of Logan Roy, the imperious CEO of the corporate causes the inventory worth of Waystar Royco, his family-controlled firm, to drop precipitously. Whereas that was fiction, and maybe exaggerated for dramatic impact, there may be analysis that appears on the market response to the deaths of CEOs of publicly traded firms, albeit with combined outcomes. A research of CEO deaths at 240 publicly traded firms between 1950 and 2009 finds that in nearly half of all of those instances, the inventory worth will increase on the loss of life of a CEO, and unsurprisingly, the reactions tended to be constructive with under-performing CEOs and damaging with extremely regarded ones. Curiously, this research additionally finds that the affect of CEOs, each constructive and damaging, was higher within the later time intervals, than in earlier intervals. A completely different research documented that the inventory worth response to CEO deaths was higher for longer-tenured CEOs in badly performing corporations, strengthening the damaging worth impact argument.

- CEO (compelled) replacements: CEOs are almost definitely to get replaced in firms, the place their insurance policies are at odds with those who their shareholders want, however given the powers of incumbency, change could require the presence of a big and vocal shareholder (activist), pushing for change. To the extent that shareholders have good causes to be disgruntled, the businesses could be considered as case research for key-person damaging worth, the place the highest supervisor is lowering worth along with his or her actions. Analysis on what occurs to inventory costs and firm efficiency after compelled replacements largely affirm this speculation, with inventory costs rising on the firing, and improved efficiency following, beneath a brand new CEO.

- CEO retirements: If CEO deaths symbolize surprising losses of key folks, and CEO dismissals symbolize the subset of corporations the place CEOs usually tend to be value-reducing key folks, it stands to purpose that CEO retirements ought to be extra of a combined bag. Analysis backs up this speculation, with the typical inventory worth response to voluntary CEO departures being near zero, with a mildly damaging response to age-related departures. It’s value noting that market reactions are typically far more constructive, when CEOs are changed by outsiders than by somebody from inside the agency, suggesting that shareholders see worth in altering the way in which these companies are run.

The constructive response, no less than on common, to CEO firing is comprehensible since CEOs often get changed by boards solely after prolonged intervals of poor efficiency at firms or private scandal, and traders are pricing within the expectation that change is more likely to be constructive. The constructive response to some CEO deaths is macabre, but it surely does replicate the truth that they’re extra more likely to happen in organizations which are badly in want of recent insights.

Managing Key Particular person Worth

A enterprise that has vital constructive worth publicity to a key individual can attempt to mitigate that threat, albeit with limits. The actions taken can fluctuate relying on the important thing individual concerned, with simpler protections in opposition to losses which are simply identifiable.

- Insurance coverage: Smaller companies which are depending on an individual or individuals for a good portion of their revenues and earnings can purchase insurance coverage in opposition to shedding them, with the insurance coverage premia reflecting the anticipated worth loss. To the extent that the insurance coverage actuaries who assess the premiums are good at their jobs, firms shopping for key individual insurance coverage even out their earnings, buying and selling decrease earnings (due to the premiums paid) in intervals when the important thing individual remains to be current for larger earnings, when they’re absent. Additionally it is true that key individual insurance coverage is less complicated to cost and purchase, when the results of a key individual are separable and identifiable, as is the case of a grasp salesperson with a monitor file, than when the results are diffuse, as is the case for a star CEO who units narrative.

- No-compete clauses: One of many issues that companies have with key folks isn’t just the lack of worth from their departure, however that these key folks can take shopper lists, commerce secrets and techniques or product concepts to a competitor. It is because of this that firms put in no-compete clauses into employment contracts, however the diploma of safety will depend upon what the important thing individual takes with them, after they go away. No-compete clauses can forestall a key individual from taking a shopper checklist or soliciting purchasers at a direct competitor, however will provide little safety when the talents that the individual possesses are extra diffuse.

- Overlapping tenure: As we famous earlier, it’s routine, when pricing smaller, private service companies to connect a major low cost to the pricing of these companies, on the expectation {that a} portion of the shopper base is loyal to the outdated proprietor, not the enterprise. Since this reduces the gross sales proceeds to the outdated proprietor, there may be an incentive to scale back the important thing individual low cost, and one apply which will assistance is for the outdated proprietor to remain on in an official or unofficial capability, even after the enterprise has been bought, to easy the transition.

- Staff constructing: To the extent that key folks can construct groups that replicate and enlarge their abilities, they’re lowering their key individual worth to the enterprise. That staff constructing contains hiring the “proper’ folks and never simply providing them on-the-job coaching and steering, but in addition the autonomy to make selections on their very own. Briefly, key individuals who refuse to delegate authority and demand on micro-management is not going to construct groups that may do what they do.

- Succession planning: For key folks on the prime of organizations, the significance of succession planning is preached extensively, however practiced sometimes. succession plan begins in fact by discovering the individual with the qualities that you just imagine are vital to copy what the important thing individual does, however being prepared to share information and energy, forward of the switch of energy.

As you’ll be able to see, a number of the actions that scale back key folks worth should come from these key folks, and which will appear odd. In any case, why would anybody wish to make themselves much less precious to a corporation? The reality is that from the group’s perspective, probably the most precious key folks discover methods to make themselves extra dispensable and fewer precious over time by discovering successors and constructing groups who can replicate what they’ll do. That could be at odds with the important thing individual’s pursuits, resulting in a commerce off a decrease worth added from being key folks for a a lot larger worth for the group, and in the event that they personal a big sufficient stake within the latter, can finish with being higher off financially on the finish. I’ve been open about my loyalty to Apple over the a long time, however whilst an Apple loyalists, I like Invoice Gates for constructing a administration staff that he trusted sufficient, at Microsoft, to step down as CEO in 2000, and whereas I cringe at Jeff Bezos changing into tabloid fodder, he too has constructed an organization, in Amazon, that can outlast him.

Determinants of Key Particular person Worth

If key individual worth varies throughout companies and throughout time, it’s value inspecting the forces that decide that worth impact, searching for each administration and funding classes. Specifically, key folks will are likely to matter extra at smaller enterprises than at bigger ones, extra at youthful corporations than at mature companies, extra at companies which are pushed by micro components than one pushed by macro forces and extra at corporations with shifting and transitory moats than corporations with long-standing aggressive benefits.

Firm measurement

On the whole, the worth of a key individual or individuals ought to lower as a corporation will increase in measurement. The worth added by a celebrity dealer will likely be higher if she or he works at a ten-person buying and selling group than in the event that they work at a big funding financial institution. There are clearly exceptions to this rule, with Tesla being probably the most seen instance, however on the largest firms, with a whole bunch and even 1000’s of workers, and a number of merchandise and purchasers, it turns into increasingly more troublesome for a single individual or perhaps a group of individuals to make a major distinction.

Stage in Company Life Cycle

I’ve written about how firms, like human beings, are born, mature, age and die, and have used the company life cycle as a framework to speak about company monetary and funding selections. I additionally imagine it offers perception into the important thing individual worth dialogue:

As you’ll be able to see, early within the life cycle, the place the company narrative drives worth, a single individual, often a founder, could make or break the enterprise, along with his or her capability to set narrative and encourage loyalty (from workers and traders). As a enterprise ages, CEOs matter much less, because the enterprise takes type, and scales up, and fewer of its worth comes from future development. At mature firms, CEOs typically are custodians of worth in belongings in place, taking part in protection in opposition to rivals, and whereas they’ve worth, their potential for value-added turns into smaller. At an organization going through decline, the worth of a key individual on the prime ticks up once more, partly within the hope that this individual can resurrect the corporate and partly as a result of a CEO for a declining firm who doubles down on dangerous development selections can destroy worth over quick intervals. The analysis offers help, with proof that CEO deaths at younger firms extra more likely to evoke giant damaging inventory worth reactions.

This life-cycle pushed view of the worth of to administration could present some perspective into the important thing individual results at each Open AI and Tesla.

- At OpenAI, for higher or worse, it’s Sam Altman who has been the face of the corporate, laying out the narrative for the way forward for AI, and Open AI stays a younger firm, however its giant estimated worth. Whereas the board of administrators felt that Altman was on a harmful path, the capital suppliers, which included not solely enterprise capitalists, however Microsoft as a joint-venture investor, have been clearly swayed not in settlement, and Open AI’s workers have been loyal to him. Briefly, as soon as Open AI determined to open the door to finally being not only a money-making enterprise, however one value $80 billion or extra, Altman turned the important thing individual on the firm, as Open AI’s board found in a short time, and to its dismay.

- With Tesla, the story is extra difficult, however this firm has at all times revolved round Elon Musk. As a younger firm, the place traders and legacy auto firms considered it as foolhardy in its pursuit of electrical vehicles, Musk’s imaginative and prescient and drive was indispensable to its development and success. As Tesla has introduced the remainder of the auto enterprise round to its narrative, and grow to be not only a profitable firm, however one value a trillion {dollars} or extra at its peak, Musk has remained the middle of the story, in good and dangerous methods. His imaginative and prescient continues to animate the corporate’s considering on every little thing from the Cybertruck to robo-taxis, however his capability for distraction has additionally typically hijacked that narrative. Thus, the controversy of whether or not Musk, as a key individual, is including or detracting from Tesla’s worth has been joined, and whereas I stay satisfied that he stays a internet constructive, since I can not think about Tesla with out him, there are various who disagree with me. On the identical time, Musk is mortal and it stays an open query whether or not he’s prepared to make himself dispensable, by not solely constructing a administration groups that may run the corporate with out him, but in addition a successor that he’s prepared to share energy and the limelight.

On the whole, the life cycle framework explains why good enterprise capitalists typically spend a lot time assessing founder qualities and why public market traders, particularly those that concentrate on mature firms, can base their investments on simply monetary monitor information.

Micro versus Macro

There are some firms the place worth comes extra from company-specific selections on merchandise/companies to supply, markets to enter and pricing selections, and others, the place the worth comes extra from macro variables. A media firm, like Disney, the place film or tv choices always have to regulate to replicate altering demand and in response to competitors, could be an instance of the previous, whereas an oil firm, the place it’s the oil worth that’s the key determinant of revenues and earnings, could be an instance of the latter.

On the whole, you might be way more more likely to discover key folks, who can add or take away from worth on the former (micro firms) than on the latter (macro firms). Think about the heated arguments that you’re listening to about Bob Iger and his return to the CEO place at Disney, with Nelson Peltz within the combine, arguing for change. Whereas a number of the forces affecting Disney are throughout leisure firms, as I famous on this submit, I additionally argued that whether or not Disney finally ends up as one of many winners on this area will depend upon administration selections on which companies to development, which of them to shrink or spin off and the way they’re run. With Royal Dutch, it’s true that canny administration can add to grease reserves, by shopping for them when oil costs are low, however for probably the most half, a lot of what occurs to it’s impervious to who runs the corporate.

Enterprise Moats

Enterprise moats discuss with aggressive benefits that firms have over their rivals that permit them to not simply develop and be worthwhile, however to create worth by incomes effectively above their price of capital. That stated, moats can vary the spectrum, each by way of sources (low cost uncooked materials, model names, patents) in addition to sustainability (some final for many years and others are transitory). Some moats are inherited by administration, and others are earned, and a few are excessive upkeep and others require little care.

On the whole, there will likely be much less key individual worth at firms with inherited moats which are sustainable and want little care, and extra key individual worth at firms the place moats should be recreated and maintained. As an example, think about two firms at reverse ends of the spectrum. At one finish, Aramco, some of the precious firms on this planet, derives nearly all of its worth from its management of the Saudi oil sands, permitting it to extract oil at a traction of the price confronted by different oil firms, and it’s unlikely that there’s any individual or group of individuals within the organizational that would have an effect on its worth very a lot. On the different finish, an leisure software program firm like Take-Two Interactive is simply nearly as good as its newest sport or product, and success could be fleeting. It ought to come as no shock that there are way more key folks, each value-adders and value-destroyers, in these companies than in most others.

Implications

The notion {that a} key individual or individuals can add or detract from the worth of a corporation is neither stunning nor surprising, however having a structured framework for inspecting the worth results can yield fascinating implications.

Ageing of key individual(s)

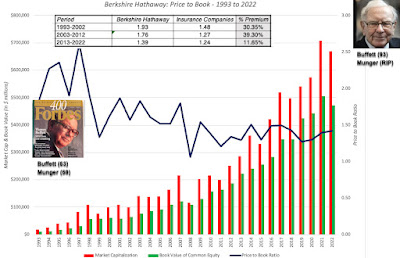

Are markets constructing within the recognition that Berkshire Hathaway’s future will likely be within the fingers of somebody apart from the 2 legendary leaders? I feel so, and one method to see how markets have adjusted expectations is by evaluating the value to e-book ratio that Berkshire Hathaway trades at relative to a typical insurance coverage firm:

Within the final decade, as you’ll be able to see, Berkshire Hathaway’s worth to e-book has drifted down, and relative to insurance coverage firms within the combination, the Buffett-Munger premium has largely dissipated, suggesting that whereas Combs and Weschler are well-regarded inventory pickers, they can’t exchange Buffett and Munger. Which will clarify why Berkshire’s inventory worth was unaffected by Munger’s passing.

Business Construction

As we shift away from a twentieth century financial system, the place manufacturing and monetary service firms dominated, to at least one the place expertise and repair firms are atop the most important firm checklist, we’re additionally shifting right into a interval the place worth will come as a lot from key folks within the group because it does from bodily belongings. It follows that firms will make investments extra in human capital to protect their worth, and right here, as in a lot of the brand new financial system, accounting is lacking the boat. Whereas there have been makes an attempt to extend company disclosure about human capital, the impetus appears to be coming extra from variety advocates than from worth appraisers. If human capital is to be handled as a supply of worth, what firms spend in recruitment, coaching and nurturing worker loyalty is extra capital expenditure than working expense, and as with all different funding, these bills must be judged by the implications by way of worker turnover and key individual losses.

Compensation

To the extent that key folks ship extra worth to firms, it stands to purpose that they are going to attempt to declare some or all of that added worth for themselves. In organizations the place they’re precious key folks, it is best to anticipate to see a lot higher variations in compensation throughout workers, with probably the most valued key folks being paid giant multiples of what the standard worker earns. As well as, to encourage these key folks to make themselves much less key, by constructing groups and grooming successors, you’ll anticipate the pay to be extra within the type on fairness (restricted inventory or choices) than in money.Whereas which will strike you as inequitable or unfair, it displays the economics of companies, and legislating compensation limits will both trigger key folks to maneuver on or to seek out loopholes within the legal guidelines.

Lest I be considered as an apologist for monstrously giant prime administration compensation packages, the important thing individual framework generally is a helpful in holding to account boards of administrators that grant absurdly excessive compensation packages to prime managers in firms, the place their presence provides little worth. Thus, I don’t see why you’ll pay tens of tens of millions of {dollars} to the CEOs of Goal (a mature to declining retail firm, regardless of who runs it), Royal Dutch (an nearly pure oil play) or Coca Cola ( the place the administration is endowed with a model identify that they’d little function in creating). This can be a bit unfair, however I’d wager that an AI-generated CEO may exchange the CEOs of half or extra of the S&P 500 firms, and nobody would discover the distinction.

In conclusion

There are numerous canards about intrinsic valuation which are in vast circulation, and one is that intrinsic valuations don’t replicate the worth of individuals in an organization. That isn’t true, since intrinsic valuations, finished proper, ought to incorporate the worth of a key individual or folks in a enterprise, reflecting that worth in money flows, development or threat inputs. That stated, intrinsic worth is constructed, not on nostalgia or emotion, however on the chilly realities that key folks can typically destroy worth, {that a} key individual in an organization can go from being a price creator to a price destroyer over time and that key folks, specifically, and human capital, usually, will matter much less in some firms (extra mature, manufacturing and with long-standing aggressive benefits) than in different firms (youthful, service-oriented and with transitory and altering moats.

YouTube Video