I used to be planning to start out this submit by telling you that Tesla was again within the information, however that will be deceptive, since Tesla by no means leaves the information. A few of that spotlight comes from the corporate’s merchandise and improvements, however a lot of it comes from having Elon Musk as a CEO, a person who makes himself the middle of each information cycle. That focus has labored within the firm’s favor over a lot of its lifetime, because it has gone from a start-up to one of many largest market cap corporations on the planet, disrupting a number of companies within the course of. At common intervals, although, the corporate steps by itself story line, creating confusion and distractions, and through these durations, its inventory value is fast to surrender positive aspects, and that has been the case for the previous few weeks. As the worth dropped under $200 as we speak (October 30,2023), I made a decision that it was time for me to revisit and revalue the corporate, considering the information, monetary and different, that has come out since my final valuation in January 2023, and to know the dueling tales which are rising concerning the firm.

My Tesla Historical past

After I write and train valuation, I describe it as a craft, and there are only a few corporations that I get pleasure from training that craft greater than I do with Tesla. Alongside the way in which, I’ve been unsuitable typically on the corporate, and in case you are a type of who solely reads valuations by individuals who get it proper on a regular basis, it’s best to skip the remainder of this submit, as a result of I’ll cheerfully admit that I will likely be unsuitable once more, although I do not know through which course. My first valuation of Tesla was in 2013, when it was a nascent car agency, promoting lower than 25,000 vehicles a yr, and seen by the remainder of the car sector with a mixture of disdain and curiosity. I valued it as a luxurious car agency that will achieve that mission, giving it Audi-level revenues in 2023 of about $65 billion, and working margins of 12.50% that yr (reflecting luxurious auto margins). To ship this progress, I did assume that Tesla must make investments giant quantities of capital in capability, and that this could create a major drag on worth, leading to a fairness worth of slightly below $10 billion.

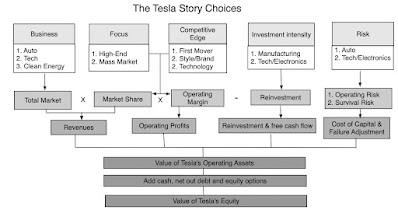

In subsequent valuations, I modified and tailored this story to mirror classes that I realized about Tesla, alongside the way in which. First, I realized that the corporate was able to producing progress far more effectively, and extra flexibly, than different auto corporations, decreasing the capital funding wanted for progress. Second, I observed that Tesla clients had been nearly fanatically hooked up to the corporate’s merchandise, and had been keen to evangelize about it, yielding a model loyalty that legacy auto corporations might solely dream about. Third, in a world the place many corporations are run by CEO who’re, at greatest, working automatons, and at worst, proof of the Peter Precept at play, the place incompetence rises to the highest, Tesla had a CEO whose main downside was an excessive amount of imaginative and prescient, reasonably than too little. In valuation phrases, that leads to an organization whose worth shifts with narrative modifications, creating not solely huge swings in worth, however huge divergences in opinion on worth. In 2016, I checked out how Tesla’s story would differ relying upon the narrative you had for the corporate and listed among the alternatives in an image:

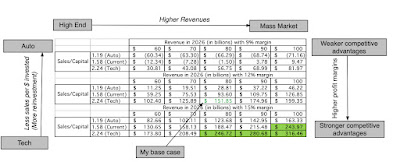

I translated these tales into inputs on income progress, revenue margins and reinvestment, to reach at a template of values:

Word that’s a number of inventory splits in the past, and the costs per share right here will not be corresponding to the share value as we speak, however the general classes contained on this desk nonetheless apply. First, if you see important disagreements about what Tesla is price, these variations come from divergent tales, not disagreements about numbers. Second, each information story or monetary disclosure about Tesla must be used to guage how the corporate’s narrative is altering, creating multiplier results that create disproportionate worth modifications.

I used to be a few week late on my valuation, for the reason that inventory value had already damaged by this worth by the point I completed it, leaving my portfolio Tesla-free, in 2023.

Tesla Replace

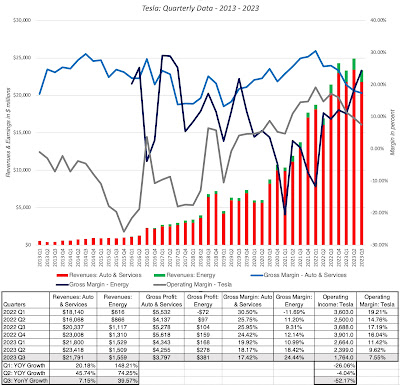

My final Tesla valuation is lower than ten months previous, and whereas that isn’t lengthy in calendar time, with Tesla, it seems like an eternity, with this inventory. As a lead in to updating the corporate’s valuation, it is smart to start out with the inventory value, the market’s barometer for the corporate’s well being. The inventory, which began the yr in a swoon, recovered shortly within the first half of the yr, peaking round mid-year at near $300 a share.

The final 4 months have examined the inventory, and it has given again a good portion of its positive aspects this yr, with the inventory dropping under $200 on October 30, 2023. Since earnings studies are sometimes seen because the catalysts for momentum shifts, I’ve highlighted the 4 earnings studies throughout the course of 2023, with a comparability of earnings per share reported, relative to expectations. The primary earnings report, in January 2023, has been the one one the place the corporate beat expectations, and it matched expectations within the April report, and fallen behind within the July and October studies.

The earnings per share focus misses a lot of Tesla’s story, and it’s instructive to dig deeper into the earnings assertion and study how the corporate has carried out on broader working metrics:

Within the twelve months, ending September 2023, Tesla reported working earnings of $10.7 billion on revenues of $95.9 billion; that places their revenues nicely forward of my 2013 projection of $65 billion, albeit with an working margin of 11.18%, lagging my estimate of 12.5%. That makes Tesla the eleventh largest car firm on the planet, in income phrases, and the seventh most worthwhile on the checklist, making it an increasing number of tough for naysayers to argue that it’s a fad that can move. Breaking down the information within the financials by enterprise grouping, here’s what the studies reveal:

- Auto enterprise: Tesla’s auto enterprise noticed income progress decelerate from the torrid tempo that it posted between 2020 and 2022, with third quarter year-on-year income progress dropping to single digits, however given the flat gross sales within the auto sector and a sluggish electrical automotive market, it stays a stand-out. The extra disappointing quantity, a minimum of for individuals who had been anticipating pathways to software-company like margins for the corporate, was the decline in revenue margins on cars from 2022 ranges, although the 17.42% gross margin within the third quarter, whereas disappointing for Tesla, would have been trigger for celebration at nearly any of its opponents.

- Power enterprise: Tesla’s vitality enterprise, which was grounded by its acquisition of Photo voltaic Metropolis in 2016, has had a robust yr, rising from 4.8% of the corporate’s revenues in 2022 to six.2% within the twelve months ending September 2023. In conjunction, the profitability of the enterprise additionally surged within the final twelve months, and whereas a few of this enhance will common out, a few of it may be attributed to a shift in emphasis to storage options (battery packs and different) from vitality era.

Briefly, Tesla’s monetary studies, are an illustration of how a lot expectations can play a job in how markets react to the information in them. The post-COVID surge in Tesla’s revenues and profitability led to unrealistically excessive expectations of what the corporate can do on this decade, and the numbers, particularly within the final two quarters, have acted as a actuality verify.

As a narrative inventory, Tesla is affected as a lot by information tales concerning the firm and its CEO, as it’s by financials, and there are three huge story traces concerning the firm that bear on its worth as we speak:

- Worth Cuts: In the course of the course of 2023, Tesla has repeatedly reduce costs on its choices, with the latest ones coming earlier this month, The $1,250 discount within the Mannequin 3 ought to see its value drop to about $39,000, making it aggressive, even on a purely value foundation, within the mass auto market in the US. A few of this value chopping is tactical and in response to competitors, present or forecast, however a few of it might mirror a shift within the firm’s enterprise mannequin.

- Full Self Driving (FSD): Tesla, as an organization, has pushed its work on full self driving to the forefront of its story, although there stays a divide in how far forward Tesla is of its competitors, and the long run prospects for automated driving. Its novelty and information worth has made it a central theme of debate, with Tesla followers and critics utilizing its successes and failures as grist for his or her social media postings. Whereas an autopilot function is packaged as an ordinary function with Teslas, it gives FSD software program, which continues to be in beta model, gives an enhanced autopilot mannequin, albeit at a value of $12,000. The FSD information tales have additionally reignited discuss of a robotaxi enterprise for Tesla, with leaks from the corporate of a $25,000 automobile particularly aimed toward that enterprise.

- Cybertruck: After years of ready, the Tesla Cybertruck is right here, and it too has garnered outsized consideration, partly due to its distinctive design and partly as a result of it’s Tesla’s entree right into a market, the place conventional auto corporations nonetheless dominate. Whereas there may be nonetheless debate about whether or not this product will likely be a distinct segment providing or one which modifications the trucking market, it has undoubtedly drawn consideration to the corporate. In actual fact, the corporate’s reservation tracker information greater than two thousands and thousands reservations (with deposits), although if historical past is a information, the precise gross sales will fall nicely in need of these numbers.

This being Tesla, there are dozens of different tales concerning the firm, however that’s par for the course. We are going to give attention to these three tales as a result of they’ve the potential to upend or alter the Tesla narrative, and by extension, its worth.

Story and Valuation: Revisit and Revaluation

In my Tesla valuations by the beginning of 2023, I’ve valued Tesla as an car firm, with the opposite companies captured in prime line numbers, reasonably than damaged out individually. That doesn’t imply that they’re including considerably to worth, however that the worth addition is buried in an enter to worth, reasonably than estimated standing alone. In my early 2023 valuation, I estimated an working margin of 16% for Tesla, nicely above auto trade averages, as a result of I believed that software program and or the robotaxi companies, along with delivering further revenues, would increase working margins, since they’re high-margin companies.

The information tales about Tesla this yr have made me reassess that perspective, since they feed into the narrative that Tesla not solely believes that the software program and robotaxi companies have important worth potential as stand-alone companies, however it’s performing accordingly. To see why, let me take every of the three information story traces and work them into my Tesla narrative:

- Cybertrucks: The best information objects to weave into the Tesla narrative is the Cybertruck impact. If the advance orders are a sign of pent-up demand and the Cybertruck represents an extension right into a hitherto untapped market, it does enhance Tesla’s income progress potential. There are two potential negatives to think about, and Musk referenced them throughout the course of the latest earnings name. The primary is that, even with intelligent design selections, at their rumored pricing, the margins on these vehicles will likely be decrease than on higher-end choices. The opposite is that the Cybertruck might very nicely require devoted manufacturing services, pushing up reinvestment wants. If Cybertruck gross sales are brisk, and the demand is powerful, the positives will outweigh the negatives, but when the thrill fades, and it turns into a distinct segment product, it might very nicely show a distraction that reduces worth. The worth added by Cybertrucks will even rely, partially, on who buys them, with Tesla gaining extra if the gross sales comes from truck patrons, coming from different corporations, than it should if the gross sales comes from Tesla automotive patrons, which can cannibalize their very own gross sales.

- FSD: As I have a look at the competing arguments about Tesla’s FSD analysis, it appears clear to me that either side have some extent. On the plus aspect, Tesla is clearly additional alongside this highway than every other firm, not solely from a technological standpoint, but additionally from enterprise mannequin and advertising standpoints. Whereas I don’t imagine that charging $12,000 for FSD as an add-on will create a giant market, reducing that value will open the door not solely to software program gross sales to Tesla drivers, however even perhaps to different carmakers. As well as, it appears clear to me that the Tesla robotaxi enterprise has now moved from doable to believable on my scale, and thus deserves being taken critically. On the minus aspect, I do agree that the world is just not fairly prepared for driverless vehicles, on scale, and that speeding the product to market could be catastrophic.

- Worth cuts: The Tesla value cuts have led to a divide amongst Tesla bulls, with some pointing to it as the rationale for Tesla’s latest pricing travails and others viewing it as a masterstroke advancing it on its mission of worldwide domination. To resolve which aspect has the extra lifelike perspective, I made a decision to check out how value cuts play out in worth for a generic firm. The primary order impact of a value reduce is adverse, since reducing costs will decrease margins and income, and it’s simple to compute. It’s the second order results which are difficult, and I checklist the probabilities within the determine under, with worth penalties:

Briefly, value cuts can, and infrequently will, change the variety of models offered, maybe offsetting among the draw back to cost reduce (tactical), make it tougher for opponents to maintain up or enter your online business (strategic) and increase the potential for aspect or supplemental companies to thrive (synergistic). This determine explains the divide on the Tesla value cuts, with the pessimists arguing that electrical automotive demand is just too inelastic for quantity will increase that can compensate for the decrease margins, and the optimists arguing that the worth losses from decrease margins will likely be greater than offset by a long-term enhance in Tesla’s market share, and enhance the worth from their software program and robotaxi companies.

To carry these tales into play, I break Tesla down into 4 companies – the auto enterprise, the vitality enterprise, the software program enterprise and the robotaxi enterprise. I do know that there will likely be Tesla optimists who will argue that there are different companies that Tesla can enter, together with insurance coverage and robots, however for the second, I feel that the corporate has its fingers full. I look out the panorama for these companies within the image under, wanting on the potential measurement and profitability of the marketplace for every of those companies, in addition to Tesla’s standing in every.

Word that the auto enterprise is, by far, the biggest by way of income potential, however it lags the opposite enterprise in profitability, particularly the software program and robotaxi companies, the place unit economics are favorable and margins a lot larger. Word additionally that estimates for the long run within the robotaxi and auto software program companies are squishy, insofar as they’re until nascent, and there may be a lot that we have no idea.My Tesla story for every of those companies is under, with income and profitability assumption, damaged down by enterprise:

With these tales in place, I estimate revenues, earnings and money flows for the companies, and in sum, for the corporate, and use these money flows to estimate a price per share for the corporate:

In sum, the worth per share that I get with Tesla’s companies damaged down and permitting for divergent progress and profitability throughout companies, is about $180 a share. That’s larger than my estimate in the beginning of the yr, with a part of that enhance coming from the upper revenue potential within the aspect companies, and expectations of a a lot bigger finish recreation in every one.

Provided that this worth comes from 4 companies, you possibly can break down the worth into every of these companies, and I achieve this under:

Simply as a word of warning, these companies are all linked collectively, for the reason that battery expertise that drives the auto and vitality companies are shared, and FSD software program gross sales will likely be tied to automotive gross sales. Consequently, you wouldn’t be capable to spin off or promote these companies, a minimum of as these estimated values, however it does present a way of traders ought to look ahead to on this firm. Thus, with a piece of worth tied to FSD, from software program and robotaxis, any indicators of progress (failure) on the FSD entrance may have penalties for worth.

An Motion Plan

As you evaluation my story and numbers, you’ll undoubtedly have very totally different views about Tesla going ahead, and reasonably than inform me that you simply disagree with my views, which serves neither of us, please obtain the spreadsheet and make your personal projections, by enterprise. So, in the event you imagine that I’m massively underestimating the scale of the robotaxi enterprise, please do make your personal judgment on how huge it could get, with the caveat that making that enterprise larger will make your auto and software program companies smaller. In any case, if everyone seems to be taking robotaxis, the variety of vehicles offered ought to drop off and present automotive homeowners could also be much less more likely to pay additional for a FSD bundle.

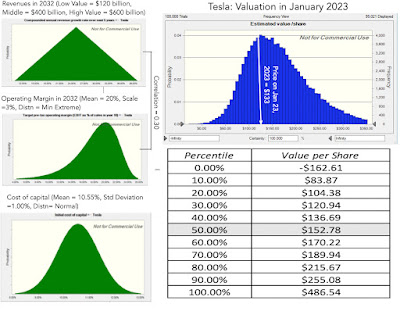

At $197 a share, Tesla stays over valued, a minimum of based mostly on my story, however a inventory that has dropped $54 in value in the previous few weeks might very nicely drop one other $20 within the subsequent few. To seize that chance, I’ve a restrict purchase at my estimated worth of $180, with the acceptance that it might by no means hit that value on this iteration. For these of you who surprise why I haven’t got a margin of security (MOS), I’ve argued that the MOS is a blunt instrument that’s most helpful when you might be valuing mature corporations the place you face a luxurious of riches (a lot of below valued corporations). Moreover, as my January 2023 simulation of Tesla worth reveals, this can be a firm with extra upside than draw back, and that make a fair-value funding one which I can dwell with. Put merely, the potential of different companies that Tesla can enter into provides optionality that I’ve not integrated into my worth, and that acts as icing on the cake.

Clearly, and this can sound just like the postscript from an e-mail that you simply get out of your funding banking mates, I’m not providing this as funding recommendation. In contrast to these funding banking e-mail postscripts, I imply that from the guts and am not required by both regulators or lawyer to say it. I imagine that traders need to take possession of their funding selections, and I’d recommend that the one manner so that you can make your personal judgment on Tesla is to border your story, and worth it based mostly on that story. After all, you might be welcome to make use of, adapt or simply ignore my spreadsheet in that course of.

YouTube Video

Knowledge and Spreadsheets